2023 05/27

PERMANENT RESIDENCY IN JAPAN - In The Context of Property Investment

Why do people try to obtain permanent residency in countries that are not their native lands?

There might be various reasons and aims, such as escaping from an oppressive regime, seeking a new academic/ business opportunity, longing for a unique cultural/artistic environment, etc. Or, they may choose to be the permanent residents of their spouses’ homelands.

Let’s see the permanent residency and its potential influence on property investment in Japan.

[ Remarks ]This article is for your information only. Before making any decisions or actions, you shall consult with professionals including lawyers, accountants, tax consultants, etc. Please refer to the disclaimer at the end of this article as well.

I. Definition

Permanent residency technically means the right for a foreign national to live in Japan without any time limitation.

Permit for permanent residency shall be given exclusively by Japan’s minister of justice. We’ll touch upon the guideline for this matter later.

On the other hand, Japan’s tax authority has a different categorization for ‘Resident except for non-permanent resident’, which looks like the ordinary concept of ‘permanent resident’. We’ll discuss the tax issues later as well.

Please remember that there are two different definitions, namely, ‘permanent resident’ for the immigration purpose, and ‘resident except non-permanent resident’ for tax one.

II. Situation in Japan

Statistically, there are 817,805 permanent residents in Japan as of June 2021. Though it may not be significant to simply compare the numbers, there are about 13.1 million lawful permanent residents in the United States as of January 2021.

As this is not a historical nor ethnological analysis, we’ll primarily discuss the contemporary elements of permanent residency in Japan.

The difference might have been caused by various reasons, including, Japan’s cultural, historical, and geographical backgrounds. If you may recall, Japan had been isolating itself both physically and diplomatically for more than two centuries since the early 1600s.

The ratio of permanent residents / total population in Japan is around 0.6%, while that of the US reaches nearly 4%.

III. Requirements

We agree with you and humbly suggest that you’d try to grasp the essential parts that particularly interest you.

Some of the keywords are bolded/underlined and comments are added in Italics for your convenience. However, you may still find this guidance complicated.

Please find the following excerpt of ‘Guidelines for Permission for Permanent Residence’ issued by the Immigration Services Agency of Japan revised on May 31, 2019.

Now, let’s take a look at the official guidelines on the permit for permanent residency.

【1】Legal requirements

1-1. The person is of good conduct. The person observes Japanese laws and his/her daily living as a resident and does not invite any social criticism.

✔ Yes, you need to behave well.

1-2. The person has sufficient assets or ability to make an independent living. The person does not financially depend on someone in the society in his daily life, and his/her assets or ability, etc. are assumed to continue to provide him/her with a stable base of livelihood into the future.

✔ Financial independence is important wherever you go.

1-3. The person's permanent residence is regarded to be in accord with the interests of Japan. Let’s see more specifically below:

A: In principle, the person has stayed in Japan for more than 10 years consecutively. It is also required that during his/her stay in Japan, the person has had a work permit (with an exception for those with the "Technical Intern Training" and "Specified Skilled Worker (i)" residential status) or the status of residence for more than 5 years consecutively.

✔ Your track record matters.

B: The person has been never sentenced to a fine or imprisonment. The person adequately fulfills public duties (duties such as the payment of taxes, public pension contribution, and public health insurance contribution, as well as notification in accordance with the Immigration Control and Refugee Recognition Act).

✔ No bad record, even a fine.

C: The maximum period of stay allowed for the person with his/her current status of residence under Annexed Table 2 of the Immigration Control and Refugee Recognition Act is to be fully utilized.

D: There is no possibility that the person could harm the viewpoint of the protection of public health.

✔ Stay healthy.

(Note): The requirements 1-1. and 1-2. above do not apply to spouses and children of Japanese nationals, special permanent residents, or permanent residents, and requirements 1-2. does not apply to those who have been recognized as refugees.

【2】Special requirements for 10-year residence in principle

This would be considered ‘special treatment’ to the requirement mentioned above 1-3. A) ‘ In principle, the person has stayed in Japan for more than 10 years consecutively.’.

2-1. The person is a spouse of a Japanese national, special permanent resident, or permanent resident, and has been in a real marital relationship for more than 3 years consecutively and has stayed in Japan for more than 1 year consecutively.

Or, the person is a true child of a Japanese national, special permanent resident, or permanent resident, and has stayed in Japan for more than 1 year consecutively.

2-2. The person has stayed in Japan for more than 5 years consecutively with the status of a long-term resident.

2-3. The person has been recognized as a refugee and has stayed in Japan for more than 5 years consecutively after recognition.

2-4. The person has been recognized to have made a *contribution to Japan in diplomatic, social, economic, cultural, or other fields, and has stayed in Japan for more than 5 years.

2-5. The person has continuously stayed in Japan for 3 years or more in cases where such a person engaged in the activities coming under any of item (xxxvi) or item (xxxvii) of the public notice (Public Notice No. 131 of 1990) specifying the activities listed in the righthand column of Appended Table I(5) of the Immigration Control and Refugee Recognition Act pursuant to the provisions of Article 7, paragraph (1), item (ii) of the same Act at a public or private organization located within the area of the plan specified in the regional revitalization plan approved under Article 5, paragraph (16) of the Regional Revitalization Act (Act No. 24 of 2005), and these activities are deemed to have made a contribution to Japan.

2-6. The person has a total score of 70 points or more based on the points calculation criteria prescribed in the Ordinance to Provide for the Criteria in the Right-Hand Column Corresponding to “Highly-Skilled Professionals as Specified in Appended Table I (2) of the Immigration Control and Refugee Recognition Act” (hereinafter referred to as “Ordinance of the Ministry of Justice”), and comes under one of the following:

A: The person who has continuously stayed in Japan as a “Highly-Skilled foreign Professional” for 3 years or more.

B: The person who has continuously stayed in Japan for 3 years or more, and who is deemed to have a total of 70 points or more when calculating with reference to the situation at 3 years before the date of the application for permission for permanent residence.

2-7. The person has a total score of 80 points or more based on the points calculation criteria prescribed in the “Ordinance of the Ministry of Justice”, and comes under one of the following.

A: The person who has continuously stayed in Japan as a “Highly-Skilled foreign Professional” for 1 year or more.

B: The person who has continuously stayed in Japan for 1 year or more, and who is deemed to have a total of 80 points or more when calculating with reference to the situation 1 year before the date of the application for permission for permanent residence.

(Note)

1. In these guidelines, for the time being, any person whose period of stay is “three years” shall be regarded as a “person who is allowed to stay up to the maximum period of stay”, as specified in the above Section 1 (3) c).

2. The “Highly-Skilled Foreign Professional” in the abovementioned 2 (6) a. is a person staying in Japan, who is deemed to have a score of 70 points or more as a result of the points calculation and the “Highly-Skilled Foreign Professional” in the abovementioned 2 (7) a. is a person staying in Japan, who is deemed to have a score of 80 points or more as a result of the points calculation.

Obviously, it’s not too easy to get the whole idea of the requirements of permanent residency in Japan. Hopefully, you’ve got the very basic essence of the program. You may want to speak with qualified professionals or the relevant government officials for the details.

IV. Upside and Downside

We’ll review the general advantage & disadvantages relating to permanent residency in Japan.

1. Advantage

Generally speaking, permanent residency would give you the following social or psychological benefits.

・ In the worst case where your divorce or outlive your spouse (supposedly a native Japanese), your permanent residency won’t be affected.

・Though it’s arguable, you may get better ‘social’ recognition, which could give you easier / quicker access to finance opportunities including mortgage loans.

・You can act on your own in Japan without any restrictions. You are a perfectly free person now and pick whatever job you wish.

・You don’t need to make visa renewals anymore.

2. Disadvantage

On the other hand, you may consider the following restrictions that bother you.

・ When you go abroad, you may need to come back to Japan within a certain time frame so as

not to lose permanent residency.

・ You may be treated as a foreign national while you stay in your native country. Your activities could be restricted and you may need to obtain a visa to enter your homeland. It depends on each country’s immigration policy.

V. Pros. & Cons. - Property Investment Viewpoints

How about the aspects of property investment?

1. Property transaction

Japan is a pretty free country in terms of the property business, where foreigners, regardless of their resident status, can buy and sell properties except for some restrictions mentioned below.

In other words, you won’t be bothered by these issues once you become a resident, but not necessarily a permanent one.

・The true advantage for ‘permanent’ residents could be easier and quicker access to mortgage loans, as discussed earlier.

・ Also, in case a non-resident buys real estate that meets certain criteria, he/she has to report the deal to Finance Minister as a capital transaction.

・ When a non-resident individual sells a property in Japan, the buyer has to withhold a certain portion of sales proceeds from the tax authority. A similar rule applies to the case where a non-resident property owner leases his/ her property in Japan. After you become a resident, you and your counterpart are free from these obligations.

2. Taxation

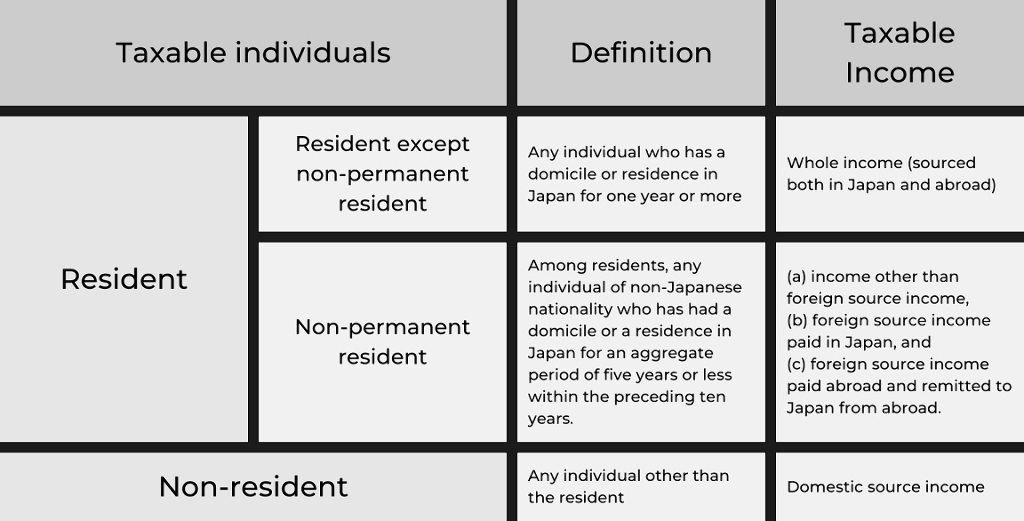

As you may remember, Japan’s tax authority has its definition for ‘resident except for non-permanent resident’. Let’s see the categorization of the individual taxpayers and the taxable income below.

Once you are classified as ‘Resident except for non-permanent resident’, your whole income, regardless of the source, is taxable by the Japanese tax authority.

As you can see from the above categorization and discussed earlier, the definition of ‘permanent residency’ differs for tax and immigration purposes.

It means that you may be treated as a ‘Resident except for non-permanent residency’ for tax purposes even without ‘permanent residency’ for the immigration one.

You are most likely to fulfill the definition of ‘Resident except non-permanent residence’ for the tax category after you live in Japan with ‘permanent resident’ for immigration purposes, though.

On top of the income tax, we have the famous ( or notorious ) inheritance tax in Japan. Though some amendments to the tax law have been enforced recently to reduce the burden, this tax might still confuse those who are from countries free of one.

We also have a relatively new tax, the so-called Exit Tax, enforced in 2015. Under this tax, when a resident in Japan leaves & ceases to have residence/ domicile in Japan, his/her unrealized capital gain on the financial asset (that meets certain criteria) can be taxable then.

As there are some complicated conditions and exclusions for this tax, please take a look at the tax authority’s notice in detail.

As a conclusion, becoming a permanent resident of Japan (especially for tax purposes) doesn’t seem to be a great attraction to you from a financial viewpoint.

You may want to study every single aspect of your business, income, lifestyle, as well as the tax regime in Japan, before thinking of becoming a resident in Japan, not to mention a permanent one.

Warning! As this part is super complicated and financially crucial, you shall consult with your accountants, tax consultants, lawyers, or NTA (National Tax Agency) officers in detail.

VI. Conclusion

Once you become a permanent resident in Japan, you can work freely without any extension of your status of residence, and you may have better access to property loans. You can enjoy some streamlining in the property transactions as well. They are obvious advantages of permanent residency.

While you shall be subject to the strict Japan’s tax system if you are categorized as ‘Resident except for non-permanent resident’. Though this cannot be called a disadvantage, some people from different tax regimes might feel it unfavorable.

Permanent residency status is not usually considered a tool for financial benefit, but you may want to take into account every single element if you are seriously seeking it in Japan.

As Japan’s population is shrinking day by day, Japanese people might have to eagerly welcome fresh fellow citizens including permanent residents from overseas….

We hope this article gives you some tips on permanent residency in Japan.

[Disclaimer]

This article is provided for general guidance purposes only without any guarantee or assurance of the accuracy/completeness of the content. Nothing in this article constitutes any recommendation, solicitation, or professional advice. Before making any decision or taking any action, you shall consult your qualified professionals such as lawyers, accountants, tax consultants, etc. with relevant knowledge and expertise.