2023 04/28

TAX BREAK FOR HOUSING MORTGAGE LOAN IN JAPAN

Good news for home buyers in Japan!

Are you interested in buying a house?

If yes, it’s time to start exploring your property!

There are many positive factors in buying a house in Japan, such as …

★ Historically Low Mortgage Interest Rate

★ Stable Property Price

★ Global Inflation Concern

★ Stable Legal Framework

★ Robust Market Liquidity

Now, you can enjoy another official & strong supportive measure by Japan’s government. This tax break scheme on the housing mortgage loan will be extended up to the end of 2025 subject to the legislature’s approval.

Though the package was originally set to finish at the end of 2022 (deadline to start living in the house, etc.), the cabinet of Japan is aiming to extend the package with various revisions.

This attractive scheme gives the opportunity for, home buyers like you who borrow mortgage loan, to mitigate your debt service cost.

The scheme may apply to other cases such as major home renovations, but we mainly cover the completed houses only in this article.

1. BACKGROUND

Let’s see the status and outlook of the deal.

● Japan’s government (the cabinet), in principle, approved the extension and revision of the tax break scheme for housing mortgage loan in December 2021.

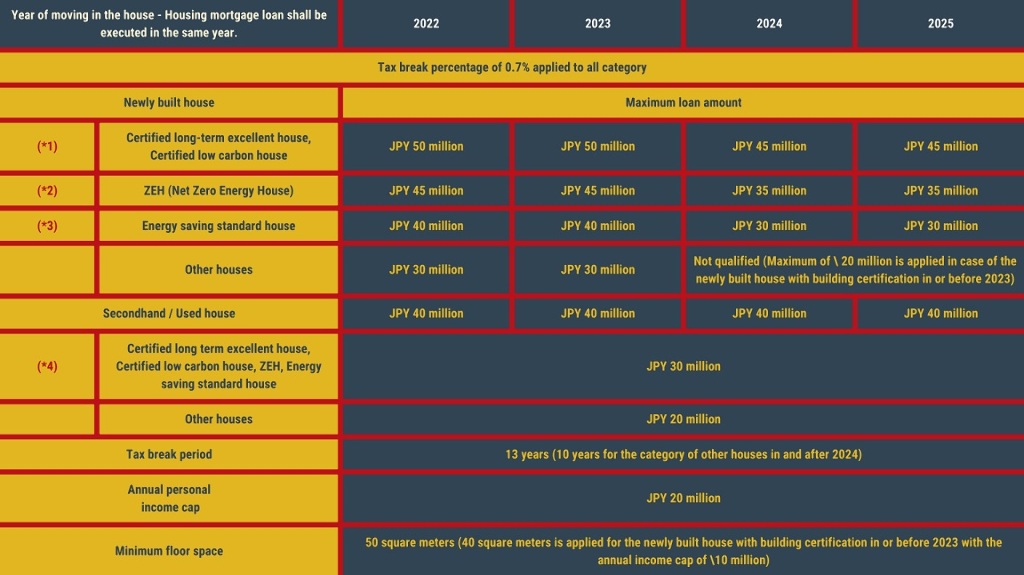

● The revision will extend the availability of the scheme until 2025 (*1) and reduce the maximum percentage of the break to 0.7% from 1.0% on the housing loan principal at each year end.

*1: Deadline for moving in the house, execution of the housing mortgage loan, and so on.

● The period of the break is up to 13 years subject to conditions.

● The government has sent the draft budget bill, including this revised scheme, to the Diet, Japanese legislature, for deliberation and approval.

● The revised scheme will be effective, usually, in or after April 2022, the first month of Japan’s fiscal year, subject to the approval by the Diet.

● The existing scheme is still valid for those who move in the houses by the end of 2022, but the deadline for loan/ purchase agreement execution expired in 2021.

2. SCHEME BASICS

2-1. NEW PACKAGE (*1)

*1: This new package is part of the budget bill and will be effective only after being approved by the legislature.

*1: Certified long-term excellent house: The structure and equipment are designed for long-term use in good condition. By creating a plan for the construction and maintenance of a long-term excellent housing and applying to the competent administrative agency, you can be certified if it meets the standards.

*2: Certified low carbon house: Specifications are stipulated in the city's low-carbon promotion law

*3: ZEH / Net zero energy house: It’s designed to achieve significant energy savings while maintaining the quality of the indoor environment by significantly improving the heat insulation performance of the outer skin and introducing a highly efficient equipment system.

*4: Energy saving standard: Insulation grade 4 and primary energy grade 4 are required.

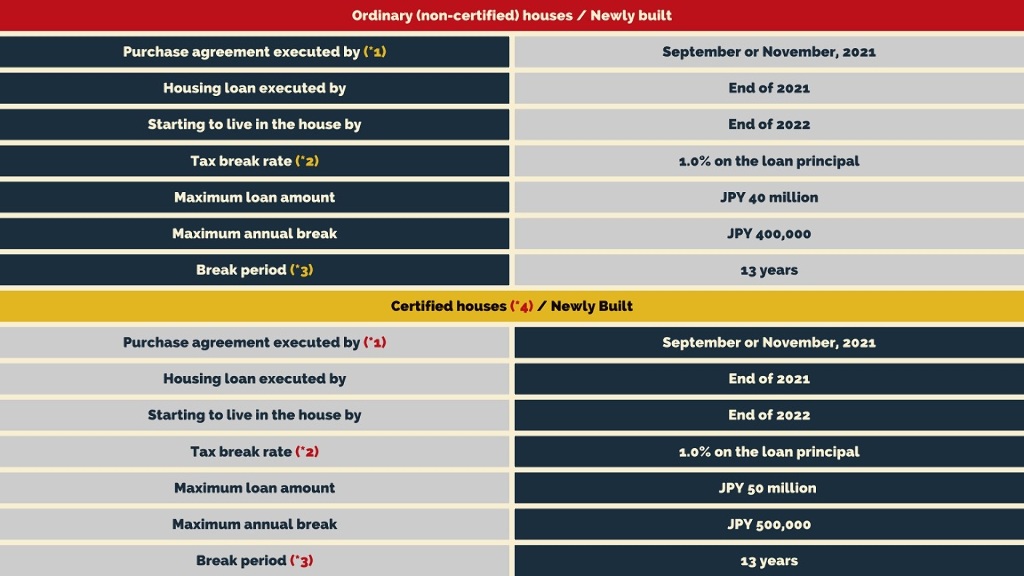

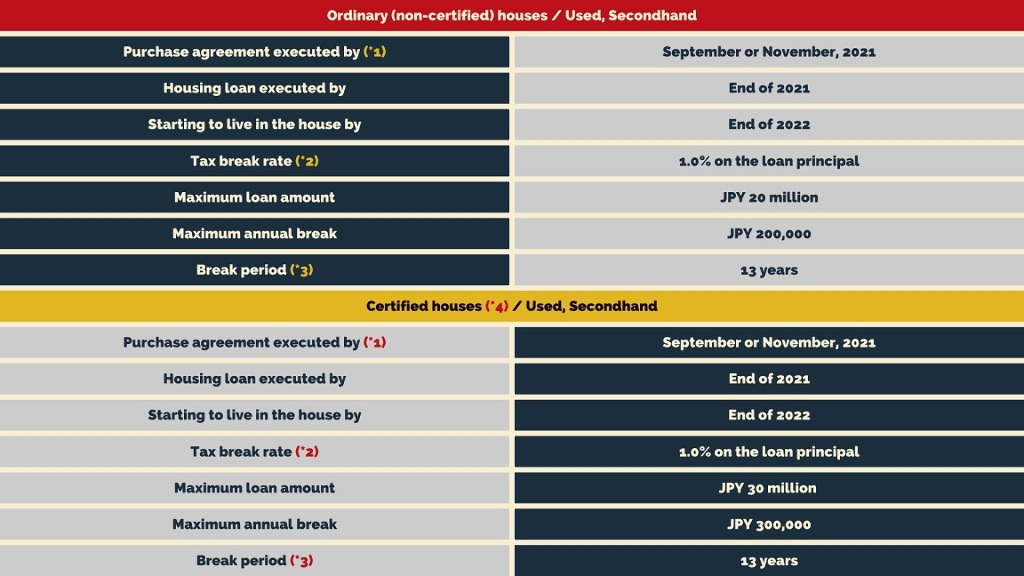

2-2. EXISTING PACKAGE

Just for your information, please find the existing scheme as below.

But bear in mind that it’s almost too late to meet the criteria. For example, if you want to be eligible, the purchase agreement of the house and loan contract shall be executed by certain dates in 2021, not 2022. Also, the subject house shall be bought with the consumption tax of 10%. Other eligible items such as renovations are not mentioned here.

Unless you happen to be qualified for this scheme, you may want to wait for the new one to kick in.

*1: Custom-made houses by September 2021. The ones ready for sale by November 2021.

*2: Break rate differs from 11th through 13th year.

*3: There are certain conditions including the consumption tax of 10% to be imposed on the purchase transaction of the property.

*4: Certified house comprises long term excellent house and low carbon house.

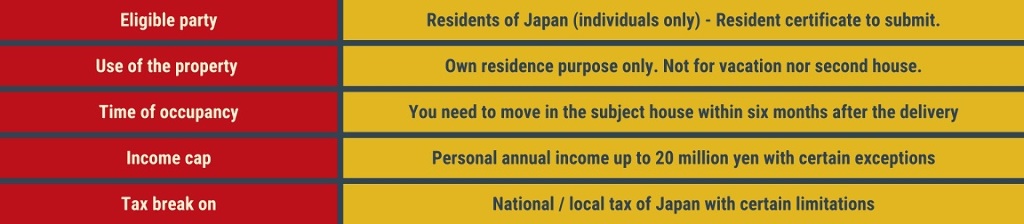

3. ELIGIBILITY / NEW SCHEME

● Since the scheme is aimed to mitigate the debt service burden for home buyers in Japan, the eligible party is limited to residents of Japan.

● Needless to say, if you want to enjoy the tax break, the Japanese tax position, ideally both the national and local ones, is necessary.

Now, let’s see who are eligible for what kind of houses and conditions for the scheme.

● As usual, there are numerous complicated terms, conditions, and restrictions in Japanese tax and legal regulations.

● You are strongly recommended to consult with your qualified professionals for details before making any decisions or actions.

4. EXEMPTION PROCESS

4-1. TAX FILING / RETURN

● After all of the criteria are met, you are now ready to claim your tax refund.

● For the break, you need to make individual tax filing / return at your local tax office in Japan. Period of individual tax return usually ends on 15th of March for the previous year’s income.

● You may need to make every process and documentation in Japanese language. The tax return process itself is getting more efficient thanks to the availability of online tax filing, though.

4-2. DOCUMENTS

Of course, you need to submit tons of documents to the tax office for the tax filing / break, including but not limited to, the following ones.

● Resident certificate of Japan (usually issued by each municipal authority)

● Loan principal certificate (loan term shall be 10 years or longer)

● House registration (to be registered and obtained at local registration office, etc.)

● Sale and purchase agreement of the house (the one in Japanese language is usually required)

● Withholding certificate of your annual salary (if you are employed and the tax withholding is done by your employer) * You should meet the annual income cap / ceiling to get qualified for the scheme.

● Documents / certificates relating to seismic resistance capacity or certified specification of the house (usually required for the used / second hand house)

The above documents and certificates are only part of those needed, and it looks complicated even to Japanese people.

5. SOME MORE INFORMATION

For those who want to learn more, let’s see some more details regarding the eligibility and others. Those mentioned here are only part of the terms and conditions.

【A】RESIDENCE PURPOSE ONLY

If you intend to receive the tax break, you shall live the house by yourself within 6 months after the delivery of the house or the completion of the construction.

● The actual condition of the residence will be confirmed by the resident certificate.

● For this reason, second / vacation houses such as villas and rental housing are not eligible.

【B】EARTHQUAKE PROOF

As everybody knows Japan is the country of earthquake, certain seismic durability is required to get eligibility for the scheme.

● Newly built houses are usually designed as per the current Building Standards Law and are supposed to be confirmed for construction.

● While the used / second hand houses may not meet the current earthquake resistance standards depending on the age of construction. In case of non-fire proof properties, such as wooden ones, the houses shall be built within 20 years. As for the others like reinforced concrete ones, the age shall be 25 years or younger.

● If you purchase used / second hand ones that do not meet above age requirements, you shall get certification of its seismic performance to get qualified for this scheme.

● Or you may present certification such as housing performance evaluation report (seismic grade 1 or higher) and others for the same purpose.

● Otherwise, you may consider covering defect insurance for the purchase of the used house. To take out this particular insurance, your house is required to comply with the current earthquake resistance standards.

【C】RENOVATION / OTHERS

● This tax break scheme applies not only to new homes but to the renovations with certain requirements.

● To get qualified, the renovations shall cost \ 1million or more, and fulfill some other terms. The renovations may include building extension, repair / remodeling of a certain scale, energy saving / barrier-free repair, and so on.

● However, in the case of energy saving or barrier-free, another remodeling tax reduction (special deduction for housing loans such as specific extension and renovation) may be more effective. Thus, you shall check the detailed terms and conditions vert carefully. As you are not allowed to use both of the packages, you may want to consult with the qualified professionals.

● Of course, there are numerous terms and conditions to apply.

6. SUMMARY

Again, this is a scheme to mitigate the debt service for individual buyers of houses like you in Japan.

Nationality doesn’t matter.

However, you have to be a resident of Japan and have tax position to make use of the break.

If you can fulfill all of the above conditions, why don’t you explore attractive Japanese houses while expecting this generous scheme is approved by the legislature.

Once the new scheme is approved by Japan’s legislature, you can get the following advantages from housing mortgage loan. Though there are many other restrictions, terms and conditions, it’s a quite favorable package from Japanese government to home buyers.

◉ New Scheme to start:

Not fixed. (Hopefully April 2022 subject to the legislature approval)

◉ Scheme to end:

2025 (deadline of moving in the house, execution of the loan, etc.)

◉ Exemption percentage:

0.7% tax break on the mortgage housing loan principal at each year end.

◉ Eligibility:

Resident of Japan with tax basis / national and local

◉ Exemption period:

13 years (Latest one to start from 2025)

◉ Use of the property:

For your own residence

◉ Maximum exemption:

JPY 400,000 per year (depending on the type of house, etc.)

◉ Maximum loan principal:

JPY 50 million (depending on the type of house, etc.)

◉ Annual income cap:

JPY 20 million per year (some exceptions apply.)

◉ Minimum floor area:

50 m² (some exceptions apply.)

◉ Type of houses:

Different terms for each housing type, such as certified long term excellent house, certified low carbon house, ZEH / Net zero energy house, Energy saving standard house, eco-friendly, etc. Ordinary house is excluded from the year of 2024 with certain exceptions.

◉ Note:

There are many other restrictions, terms and conditions to apply.

7. NEXT STEP

You should always watch out before jumping on any juicy deals as the successful property buyers usually say. First, you should talk to your accountants, tax lawyers or any other qualified professionals with knowledge and practical expertise in Japanese property, tax and finance deals.

Also, you should call your property agent to get general and particular market situation as well as the list of properties suitable for you!

Now, let’s explore your dream house in Japan!

[Disclaimer]

This article is provided for general guidance purpose only without any guarantee nor assurance of the accuracy / completeness of the content. Nothing in this article constitutes any recommendation, solicitation, nor professional advice. Before making any decision or taking any action, you shall consult your qualified professionals such as accountant, tax consultant and lawyers with relevant knowledge and expertise.