2023 01/27

Buying vs. Renting a property in Japan: Which one should a foreigner choose

For foreigners, who are planning to live in Japan for a long time, it may be a difficult decision to make when choosing to buy or rent a property.

Renting is normally quicker to choose and cheaper than buying a property. Therefore, it sounds like the more reasonable option to begin with. However, if you pay the same amount of money towards a monthly mortgage and rent in the long run, buying a property could be a better investment.

The key to avoiding mistakes in real estate is to know the advantages and disadvantages of both renting and buying a property in advance. Then you can apply your own personal needs and situations to come to a conclusion. We will suggest how to choose what option to take by comparing them together.

Foreigners have a choice to buy or rent a property in Japan

Can foreigners purchase or rent estate?

To get straight to the point, you can buy or rent a property in Japan without any legal restrictions as long as you meet the financial requirements. Visas and permanent residency are irrelevant for renting or buying a property.

Moreover, foreigners are subject to real estate acquisition tax, fixed asset tax, and other taxes related to the purchase and ownership of real estate properties in Japan just like other Japanese people.

Although the new law “Land Use Restriction Bill”, discusses regulating the use of the land around important facilities such as Self-Defence Forces bases and nuclear power plants, it had been passed in Japan on 21 June 2021, at this point foreigners are still able to buy or rent real estate the same as before.

According to the Immigration Services Agency of Japan, the number of foreign residents in Japan now exceeds 2.8 million. Consequently, real estate rates for the purchase and rental market are increasing. According to the survey of real estate businesses conducted by the Ministry of Land, Infrastructure, Transport, and Tourism in 2015, the number of real estate agents who felt that transactions by foreign customers had increased in both leasing and sales operations. Comparing this with 10 years ago shows about 60% of the respondents in the leasing business and over 80% in the sales business.

From this point of view, the market for real estate leasing and sales to foreigners is expected to continue to grow.

Advantages & Disadvantages of renting in the Japanese real estate market

When you rent a property in Japan, whether it is a house, office, or store, you pay a rental fee (usually monthly) to the landlord. This could be an advantage or disadvantage depending on your judgment.

The advantages and disadvantages of renting are as follows.

Advantages of renting a property

✔ Allows you to relocate to another property in a different area in a short period of time.

✔ You do not need to worry about paying back a mortgage.

✔ The landlord has responsibility for maintenance costs for the building.

✔ You are not responsible for paying legal fees such as property tax.

Disadvantages of renting a property

✘ You have to keep paying monthly while living or using the property.

✘ The monthly rent will be raised.

✘ You cannot repair or redecorate a property without permission from your landlord.

Advantages & Disadvantages of buying in the Japanese real estate market

Buying a property would mean you will pay a mortgage (usually monthly). This could also be an advantage or disadvantage depending on your judgment.

The advantages and disadvantages of purchasing real estate are as follows.

Advantages of buying a property

✔ You can be an owner.

✔ The value of the house can rise, equal to a profit.

✔ The owner can repair or renovate the property freely.

✔ Once the mortgage is paid off, the billing expenses will be lower.

Disadvantages of buying a property

✘ It is difficult to move to another area.

✘ The mortgage deduction cannot be available in some cases (e.g. borrowing a mortgage for less than 10 years).

✘ Property tax and city planning tax are imposed on the owner.

✘ In the case of apartments, you pay parking fees and management fees every month.

✘ Family members have to live separately for financial reasons.

(For example, you can get a mortgage deduction for 10 years or 13 years after you live in the property. However, if you have to change your job during this period of time that required you to move houses, you would lose the deduction. Therefore, one member of the family will move to work, but the rest of the family has to remain in the original house to receive the deduction. For this reason, many households choose to live alone away from their family).

Rent or Buy: Which one is worth choosing for a foreigner?

There are pros and cons of renting or buying a property, but we have shown now it can be fairly generalized to Japanese people.

Therefore, you might think “how about foreigners?”

Foreigners can rent or buy a property in the same way as Japanese people. This means that the renting or buying experience will be similar for both foreigners and Japanese people.

However, there are some pros and cons, especially for foreigners.

Advantages of renting or buying a property specifically for foreigners

Japan is worth investing in real estate. The reason is that it is classified by OECD (Organisation for Economic Co-operation and Development) as “Rank A” which means that the country has political stability and has a low risk for ethnic conflicts such as terrorism.

The Japanese real estate market is large and stable, this creates an appeal abroad surrounding the market and making it grow in popularity. Combined with the weak yen, real estate investment from foreigners is rising. There have been some developments in Japan such as the development of loans for foreigners, which is expected to make it easier for foreigners to buy and sell real estate.

Disadvantages of renting or buying a property for foreigners

The language barrier can easily become an obstacle for foreigners.

Although real estate agencies, implementing services for foreigners in support of foreign languages, are increasing, there are some inadequacies in responding to customers. If you do not understand Japanese to some extent, you could be frustrated in communicating with the agencies and searching for information about renting or buying a property.

Foreigners can be eligible for a mortgage, however, using a mortgage is more limited to them especially if your financial circumstance does not meet the requirements.

Most financial institutions consider "permanent residents" to be eligible for loans, depending on the type of visa (status of residence).

Is renting cheaper than buying?

When it comes to renting and buying, there is a common stereotype that renting is overall more affordable. However, it does not always mean that renting is more affordable in comparison to buying a property.

To illustrate the idea of how buying can be a financially better investment than renting, is by comparing the total costs for purchasing and renting a house.

The calculations to show purchase and rental housing costs is only a guide that has been simplified to provide perspective for anyone to understand.

Total payment varies from case to case between renting and loans

Behind renting or buying:

・Renting a house: rent is 120,000 yen per month

・Buying a house: a new house; the price is 25,000,000 yen; deposit is 20% of the purchase price;

duration of mortgage is 30 years (bonus 0 yen); interest rate is 0.5%.

Case 1: Renting vs. Buying a house (Initial costs)

*1: Taxes, brokerage fees and etc.

At this point, renting a house is 6,390,000 yen cheaper than buying one in total.

Case 2: Renting vs. Buying a house (costs after living 5 years)

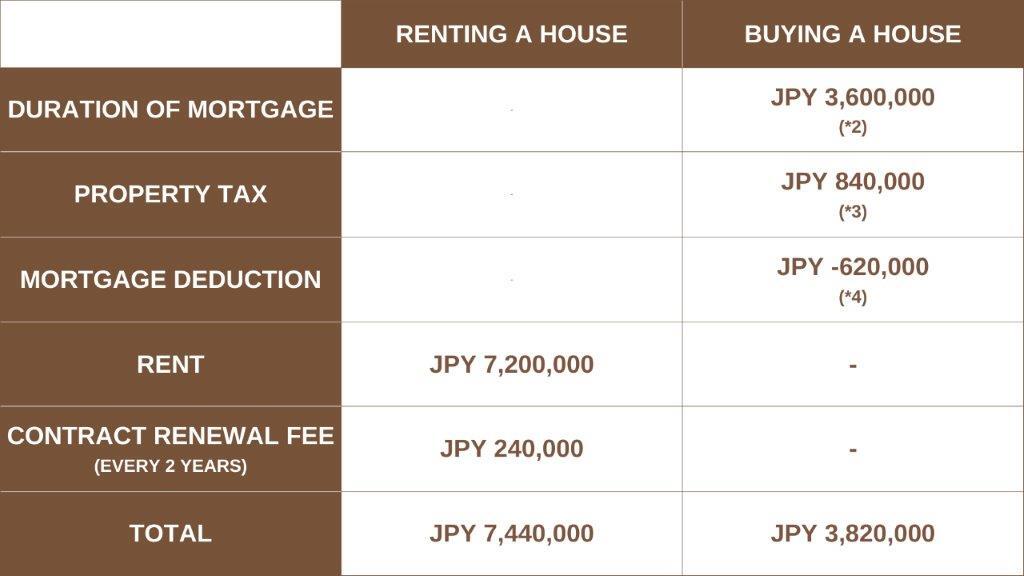

After you buy a house, you may pay back the mortgage every month. You also have to pay taxes such as property tax every year. Meanwhile, you might gain a mortgage deduction for 10 years. From these points of view, the total cost of renting or buying a house over 5 years is below.

*1: Round off to the nearest 10,000 yen

*2: 60,000 yen per month x 60 months

*3: (The price of the house x 70% x 1.4%) x 1/2 x 3years & (The price of the house x 70% x 1.4%) x 2years

*4: Mortgage balance for 5 years x 0.7%

If you rent a house for 5 years, in total you have paid 7,440,000 yen. If you buy a house, you will spend 3,82,000 yen after taking the mortgage deduction. From this, renting is 3,620,000 yen more expensive than buying. However, with the initial costs, buying is 2,770,000 yen more expensive than renting. In short, renting a house is still cheaper than buying one 5 years later.

Case 3: Renting vs. Buying a house (after living for 40 years)

Now, as a third example, what happens after 40 years of living in a rented or purchased house?

*1: Round off to the nearest 10,000 yen

*2: 60,000 yen per month x 360 months

*3: Mortgage deduction for 13 years.

It may be clear that if you continue to live in the same place for a long time, you will buy a house rather than rent it. Although the owner keeps paying a property tax every year even after paying off the mortgage, it would be less than renting (the older the house gets, the more the assessed value is lower). For example, a property tax for a 27-year-old house is about 70,000 yen.

It is possible for you to make a profit by selling your house. However, if you rent a house, you only are paying your money towards someone’s account.

To summarise:

・The initial cost of buying is more expensive.

・In some cases, monthly repayments are less than renting.

・If you live in the same house for a long period of time, in some cases, buying can become cheaper.

Which one is better overall?

Whether renting or buying is better for you, it ultimately depends on your personal wishes and circumstances.

This is because some people who are unsure about renting or buying real estate could be more concerned about cost, while others are more concerned about liveability.

Nissei Research Institute has summarised the tendency of foreign workers to choose their residences based on their employment situation of foreign workers.

The housing characteristics of foreign workers residing in Japan are categorized by industry. For example, in the manufacturing industry, where there are many Japanese-Brazilian workers.

Among those workers, there are single people who prefer apartments because they are more cost-conscious, while families with children tend to choose detached houses with gardens so that they can have barbecues.

Foreigners who are interested in real estate investment buy a property because of the economic appeal of the size and stability of the Japanese real estate market.

If you are a foreigner who is genuinely interested in the "akiya" and "kominka", then the benefits of acquiring what you like are much greater than the benefits of making a profit.

From these points of view, choosing a rent or your own property overall depends on your priority. “What you want with the property “will then make the right decision.

Take advice from a real agency, if you cannot choose

Renting or buying real estate in Japan is possible for foreigners without restrictions.

You should take advantage of the opportunity to choose whether to rent or buy relatively freely and choose the one where there are the most advantages for you.

If you are still confused, why not consult with a real estate agency that caters to foreigners?

A real estate agency that is used to dealing with foreigners will have many properties for foreigners and can also give you advice on the necessary documents and procedures.